File your Form 990-N Online

in 3 Simple Steps

Search EIN, Choose Tax Year, Review and transmit to the IRS

Deadline to File Form 990-N Online

The deadline for filing 990-N can vary depending on the organization's accounting period.

Calendar Tax Year

If the organization follows a Calendar Tax year (January - December), the due date to file Form 990-N is May 15.

Fiscal Tax Year

If the organization follows a Fiscal Tax year (Other than the calendar tax year), then their 990-N deadline is the 15th day of the 5th month after their corresponding tax year ends.

Note: If the due date falls on a Saturday, Sunday, or legal holiday, the next business day will be the deadline.

Information Required to File Your Form 990-N Electronically!

Following are the details that the organizations should have for

filing Form 990-N.

- The Organization’s Employer Identification Number (EIN)

- Respective Tax Year

- The Organization’s Legal Name and Address

- The Organization’s Web Address

- Various Names of the Organization (if applicable)

- Confirmation of Gross Receipts of $50,000 or less

- Written Statement regarding their organization’s going

out of business.

Choose fileform990nonline.com for Easy and Secure Form 990-N Filing

Get started with our intuitive e-filing software and experience an easy and secure 990-N filing process.

3-Step Filing Process

File from any device

View Filing History

Get Real-Time Updates

Re-transmit Rejected Returns

Live Customer Support

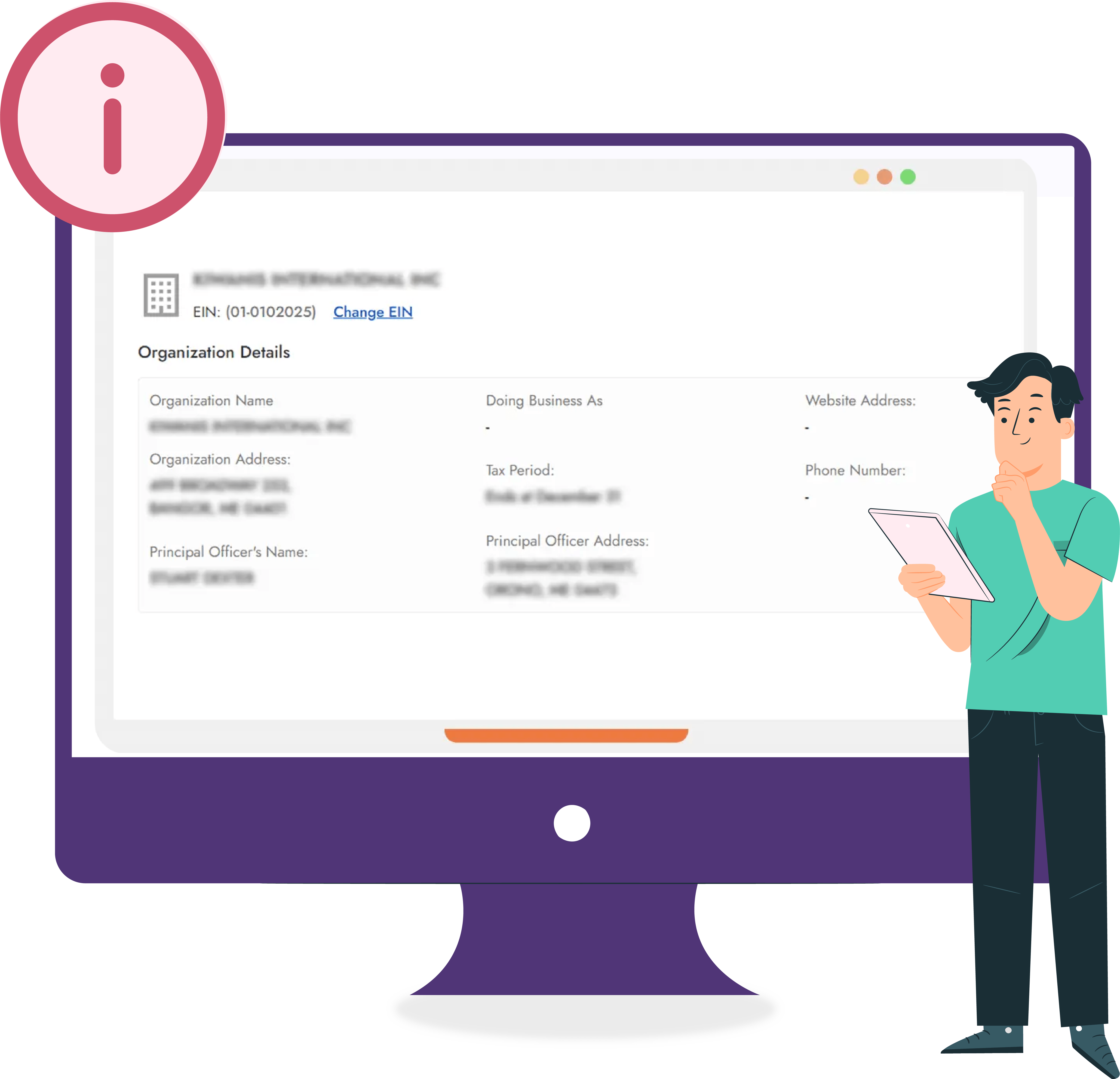

How to E-file your Form 990-N?

Form 990-N can be easily filed in 3 simple steps.

Step 1

Enter Your Organization EIN

Step 2

Choose the Tax year

Step 3

Review & Transmit it to the IRS

Pricing to File Form 990-N Online

E-file your Form 990-N for $19.90 per return

OTHER SUPPORTED FORMS

- Form 990-EZ

- Form 990

- Form 990-PF

- Form 990-T

- Form 990-EZ

- Form 990

- Form 990-PF

- Form 990-T

Frequently Asked Questions

1.

What is Form 990-N, and Who Must File it?

Form 990-N, also known as the e-Postcard, is filed by tax-exempt organizations with annual gross receipts less than or equal to $50,000 as part of their annual filing requirements.

2.

Is there any Extension form available for Form 990-N?

No! Unlike other 990 forms, the Form 990-N deadline cannot be extended.

3.

What are the late filing Penalties for Form 990-N?

Form 990-N has no penalties. But in some cases, if the organization does not file their 990-N for three consecutive years, then their tax-exempt status will be revoked automatically.

4.

Should Form 990-N be filed Electronically?

Yes! As per the IRS, Form 990-N must be filed electronically. There is no paper form available.

See why our clients choose Tax990!

See why our clients choose Tax990!

Start E-filing your Form 990-N Online

CONTACT US

Email: support@tax990.com

Phone no: 704.839.2321